ARYankee

Well-known member

- 1,983

- 33

- 48

- Location

- Benton, AR

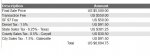

I'm looking at a vehicle in another state on govplanet, and the other state's sales tax is higher than my state. I have read govplanet's sales tax collection procedure but it still isn't making too much sense.

I have read this part:

How do I obtain a sales tax refund or pay for an increase adjustment?If you have an exemption certificate that was not submitted at the time of sale:

I am still a bit confused. I understand it that I can ask for a refund which would be the difference in sales taxes since my state is lower. I know I will be calling my revenue office in the morning to see what their stance on the sales tax is. I want to avoid paying double sales tax and of course I want to pay the lower amount. I'm wondering what everyone else's experience is and especially anyone from Arkansas. It's been quite a while since I have bought anything and all I've had to pay when I did was GL's 10% fee.

I have read this part:

How do I obtain a sales tax refund or pay for an increase adjustment?If you have an exemption certificate that was not submitted at the time of sale:

- You can request a sales tax refund or adjustment from your My Account page:

- Click on “Adjust sales tax” in the Buying section and upload a valid sales tax exemption certificate.

- You have 10 business days from your date of purchase to submit a valid exemption certificate in order for IronPlanet to process a refund. After 10 business days, you will need to submit any refund request directly to the state for which the original sales tax was collected and remitted by IronPlanet.

- You can request a sales tax refund or adjustment from your My Account page:

- Click on “Adjust sales tax” in the Buying section and upload a Bill of Lading.

- You have 10 business days from your date of purchase to submit a bill of lading in order for IronPlanet to process a refund or an adjustment. After 10 business days, you will need to submit any refund request directly to the state for which the original sales tax was collected and remitted by IronPlanet.

- If your items are being shipped to a destination with a higher sales tax rate, IronPlanet will issue a new invoice to you for those additional taxes.

I am still a bit confused. I understand it that I can ask for a refund which would be the difference in sales taxes since my state is lower. I know I will be calling my revenue office in the morning to see what their stance on the sales tax is. I want to avoid paying double sales tax and of course I want to pay the lower amount. I'm wondering what everyone else's experience is and especially anyone from Arkansas. It's been quite a while since I have bought anything and all I've had to pay when I did was GL's 10% fee.